Finding the right type of life insurance means considering things like your personal finance goals, your budget, and the factors that affect your eligibility. Fidelity Life is one of the best life insurance companies that offers a variety of life insurance plans to meet your needs at every age and stage of life.

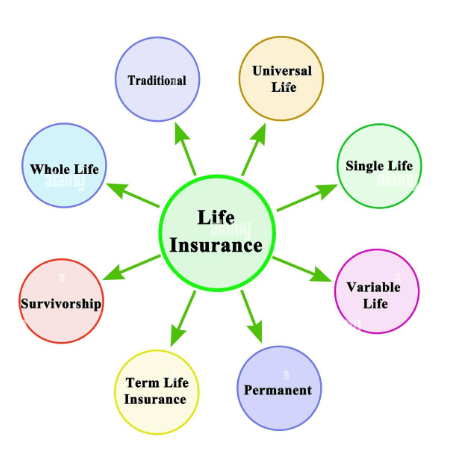

Here’s a closer look at the types of life insurance plans available.

What are the 2 types of life insurance?

Life insurance products are often grouped into two main types: term and permanent. Term life insurance policies last for a set period, while permanent life insurance provides lifetime coverage and can accrue cash value. Generally, term life insurance is more affordable than permanent coverage.

As you learn about different life insurance types, one of the biggest decisions you’re likely to make is choosing term vs. whole life insurance. Both policies offer advantages to policyholders depending on their needs. Here’s a look at how they stack up.

| Term Life | Whole Life | |

|---|---|---|

| Length of Coverage | You choose a term length (10, 15, 20, 30 years) based on your needs. | Your coverage lasts your lifetime, as long as you pay your premium. |

| Premium | Term life insurance premiums are usually the most affordable. | Whole life insurance premiums are more expensive than term premiums for same coverage. |

| Medical Exam | A medical exam is not always required. | A medical exam is usually required–but not with Fidelity Life. |

| Guaranteed Payout | Yes, a payout is guaranteed for the duration of your term as long as premiums are paid. | Yes, a payout is guaranteed for the life of your policy as long as premiums are paid. |

| Cash Value | A term life policy does not build a cash value. | A whole life policy can build tax-deferred cash value. |

Term life insurance

Simple, flexible, and affordable, term life is one of the best types of life insurance for many people. But how does term life insurance work?

It provides life insurance benefits for a set period of time to protect your family when you need it most, like when you’re raising kids or building your career. There are plenty of types of term life insurance options available to meet specific needs and budgets.

Types of term life insurance

Term life insurance is available in several terms, or for various lengths of time. If you die during the term, your life insurance pays out a death benefit to your beneficiary on the policy to help ease the financial burden. Term life insurance works by acting as an income replacement. Once you reach the end of the term, you can renew your policy, buy a new life insurance policy, or let it expire if you don’t need coverage anymore.

When choosing a term length for any life insurance product, consider the reasons you’re buying the policy. Your age, financial goals, budget, and the life insurance cost will help determine which type of policy may be best for you. The most common types of life insurance term lengths available are:

10-year term

A 10-year term life insurance policy can be a good option if you have short-term needs or don’t qualify for a longer policy. For example, if you have teenage children and just need coverage until they finish college, a 10-year policy can provide the protection you need during those critical years. Older adults may also choose a 10-year plan to provide coverage for a few years until they retire or pay off any remaining debts.

15-year term

Some people may need a bit more time to cover big debts or financial obligations. A 15-year term life insurance policy keeps you covered for a decade and a half, enough time for many people to pay off debts and ride out the years until retirement or the end of a mortgage. These types of policies are often available in your later years, too.

20-year term

A 20-year term life insurance policy provides longer-term insurance coverage, making it a good option for parents of young children or people with other long-term obligations. It can help you cover your family financially from the time your children are born to the time they’re out on their own, ensuring there’s financial support available should you die suddenly.

30-year term life

The longest term length generally available, a 30-year term life insurance policy is a solid investment for those who are younger and just starting out. It’s long enough to pay off most mortgage loans. It may also leave behind enough funds to meet long-term needs for family members, such as money to pay for your child’s college education if you pass away suddenly while they’re young.

Level term life

Most term life policies are level term life insurance . With level term life, your payments are the same for the entire length of the policy. Once your insurance company sets your rates, you don’t have to worry about them going up because of your age, health, or other factors. The predictability of payments can make it easier to fit a policy into your family budget.

Renewable term

A renewable term life insurance policy is a type of life insurance that guarantees that you can renew the policy after the term ends. If you develop health issues or other problems that could make it difficult to qualify for a new policy, renewable term can provide peace of mind that you’re still able to remain covered.

Keep in mind that your insurance company will adjust your rates based on your current age, so you can expect to pay higher premiums. Most yearly renewable term policies allow you to renew one year at a time, often into your 80s or 90s.

Permanent life

Need a policy that’s guaranteed to stay in place? A permanent life insurance policy remains in effect as long as the policyholder pays the premiums on it.

Permanent life insurance is more expensive than term life insurance, but can be the best product for people with lifelong needs. For example, some people choose permanent life insurance to leave a legacy for their children or to make sure funds are available for a spouse or relative with disabilities.

In addition to a death benefit, or a lump sum payment at the end of a person’s life, permanent life insurance also includes a cash value component. The cash value builds during the policy’s entire life, and you can borrow from it as needed or use it as collateral for a loan.

Types of permanent life insurance

Just like term life, there are different permanent life insurance options.

Whole life

Whole life insurance is the most common form of permanent life insurance. Known for its dependability, the premium and death benefit on whole life policies remain the same during the life of the policy.

Whole life insurance typically starts to build cash value several years into the policy. These policies also sometimes pay dividends, which you can reinvest in the policy to increase the death benefit.

Cash value life

Cash value life insurance includes any permanent life insurance policy that offers cash value. With permanent life insurance policies, a portion of each payment you make goes toward the cash value in the policy. That cash value grows over time, allowing you to spend those funds or let them continue to grow.

Final expense insurance

Designed for people 50 and older, final expense coverage , or burial insurance, provides a payout to help cover funeral costs and other end-of-life expenses. Final expense insurance policies offer a lower death benefit than term or permanent life, and qualifying is generally quick and simple.

Variable life insurance

Similar to other types of permanent life insurance, variable life insurance provides a death benefit to beneficiaries upon the policyholder’s death. However, what sets it apart is the investment component. With this life insurance, you can allocate a portion of your premiums into investment accounts, such as mutual funds, stocks, or bonds. These investments have the potential to grow over time, allowing you to accumulate cash value within the policy.

One key benefit of this life insurance is the potential for higher returns compared to traditional permanent life policies. Because you can invest in market-based instruments, you have the opportunity to earn greater returns, especially over the long term.

However, it’s essential to acknowledge that this life insurance policy also comes with inherent risks and volatility. Since the policy’s cash value is tied to the performance of the underlying investments, it can fluctuate based on market conditions. This means losses can occur, especially during periods of market downturns.

Variable life insurance is typically suitable for individuals with a higher risk tolerance and a long-term investment outlook. It may appeal to you if you’re looking for a life insurance product that offers the potential for growth beyond what traditional permanent life coverage can provide.

Additionally, variable life insurance may be suitable for you if you want more control over how your policy’s cash value is invested and are comfortable actively managing your investment allocations.

Universal life insurance

One of the defining features of universal life insurance (ULI) is its flexibility in premium payments. As a universal policyholder, you can adjust the amount and frequency of your payments within certain limits according to your changing financial circumstances.

Another key characteristic of universal life policies is the cash value investments component. A portion of the premiums you pay is allocated to a cash value account, which accumulates on a tax-deferred basis. Once you accumulate enough cash value, you can access it during your lifetime through withdrawals or loans.

ULI also offers flexibility in death benefit options. Policyholders can choose between a level death benefit amount, which remains constant throughout the policy’s life, or an increasing death benefit amount, which grows over time based on the cash value accumulation. This allows you to customize your coverage to meet your specific needs and objectives.

While ULI offers flexibility and potential for cash value growth, it also comes with certain risks and considerations. It’s important to note that the performance of the cash value account is not guaranteed and may fluctuate based on market conditions.

Indexed universal life insurance

Indexed Universal Life Insurance is a type of permanent life coverage that combines the features of traditional ULI with the potential for higher returns linked to the performance of a stock market index, such as the S&P 500.

One key feature of indexed ULI is its flexibility in premium payments. Like traditional ULI, you can adjust the amount and frequency of your payments within certain limits. This flexibility allows you to tailor your payments to changing financial circumstances, such as fluctuating incomes or variable expenses.

Additionally, rather than earning a fixed interest rate like traditional ULI, the cash value in an indexed universal life policy has the potential to grow based on the performance of the chosen index. This offers policyholders the opportunity for potentially higher returns than traditional ULI although returns are subject to caps, floors, and participation rates set by the life insurance company.

Another feature of indexed ULI is the guaranteed minimum interest rate provided by the life insurance company. While the cash value growth is linked to the performance of the chosen index, most indexed ULI policies also include a guaranteed minimum interest rate that ensures the cash value will not decrease, regardless of how the index performs. This provides you with security and stability, knowing that your cash value will continue to grow over time, even in market downturns.

Survivorship life insurance

Also known as second-to-die life insurance, survivorship life insurance is a type of joint policy that covers two individuals and pays out the death benefit upon the death of the second insured person.

This insurance product is commonly used by couples or partners who want to ensure their heirs are financially protected and estate taxes are covered after death.

One of the main benefits of survivorship life insurance is its potential for lower premiums compared to individual policies. Because the policy covers two individuals and pays out upon the death of the second insured person, insurers typically charge lower premiums than they would for two separate policies covering each individual. This can make survivorship life insurance an attractive option for couples or partners who want to maximize their coverage while minimizing costs.

Guaranteed universal life insurance

Guaranteed Universal Life Insurance (GUL) is a type of permanent life policy that offers guaranteed coverage for a specified period, typically until a certain age, such as 90 or 100, as long as you pay your premiums on time.

Unlike other types of permanent life insurance, such as indexed or variable ULI, GUL policies do not have cash value or investment options. Instead, they focus solely on providing a guaranteed death benefit to beneficiaries upon the insured person’s death.

Since GUL policies do not have a cash value component or investment options, premiums are generally lower than those for indexed or variable universal life insurance policies. This can make GUL a cost-effective option for individuals who want permanent life coverage without the additional expenses associated with cash value accumulation or investment management.

Variable universal life insurance policy

Variable universal life insurance combines the features of ULI with investment options similar to those found in variable life insurance policies. This hybrid structure provides a blend of security and growth potential.

At its core, Variable Universal Life Insurance functions similarly to traditional universal life insurance in terms of providing lifelong coverage and a cash value. You can adjust your premium payments and death benefits within certain limits, providing adaptability to changing financial circumstances.

Variable Universal Life Insurance also integrates investment options like those in variable life insurance policies. This means you can allocate a portion of your premiums into separate accounts containing a variety of investment options. This way, you can potentially earn higher returns compared to traditional fixed interest rate policies.

However, with the potential for higher returns comes increased risk. Policyholders bear the risk of market volatility, meaning that the performance of the investment accounts can fluctuate based on market conditions. During market downturns, the policy’s cash value may decrease, potentially impacting the policy’s long-term viability and coverage.

Additional types of life insurance

Have special needs based on your health or other factors? Consider a few additional types of life insurance that may be a good fit.

- Accidental death benefit provides a payout if you die as the result of an accident. These policies generally offer guaranteed approval to people who meet the age criteria, with no medical exam required.

- Simplified issue life is a type of life insurance policy that doesn’t require a medical exam, making it faster to get life insurance coverage. Coverage amounts tend to be a little lower and rates are higher than typical term or permanent policies.

- Guaranteed issue life offers no-questions-asked coverage with no health requirements. It’s typically best for people who can’t qualify for other types of policies because of medical issues.

Life insurance riders

Life insurance riders can update, add, or otherwise change a life insurance policy to make it a better fit for your needs. Some riders increase your coverage amount or expand coverage to a spouse or child. Others cover accidental death, provide coverage for inflation increases, or provide an early payout in the event of a terminal illness.

You typically choose a rider when you buy your policy. In some cases, it may be possible to add riders to an existing policy. Some additional types of life insurance riders and policy enhancements you should consider include:

- Long-term care rider : This rider provides coverage for long-term care expenses and medical bills if the insured becomes unable to perform activities of daily living or requires assistance due to a chronic illness or disability.

- Return of premium rider : With this rider, the insurance company refunds a portion or all of the premiums the policyholder pays if certain conditions are met, such as reaching the end of the policy term without a death benefit payout. This rider can provide a financial safety net and peace of mind, knowing that premiums will not be lost if the policy’s death benefit is not utilized.

- Waiver of premium rider : In the event of a disability or serious illness that renders the insured unable to work and pay premiums, the waiver of premium rider waives future payments while keeping the policy in force. This ensures that coverage remains intact during times of financial hardship, allowing the insured to focus on recovery without worrying about lapsing coverage.

- Accelerated death benefit rider : Also known as a living benefits rider, this option allows the insured to access a portion of the death benefit in advance if diagnosed with a terminal illness or specified medical condition. The accelerated death benefit can help cover medical expenses, palliative care, or other end-of-life costs, providing financial relief and support when it’s needed most.

- Children’s term rider : This rider provides life insurance coverage for the insured’s children, typically for a specified term. It offers financial protection in the event of a child’s death, helping to cover funeral expenses or other costs associated with the loss of a child. Additionally, some children’s term riders offer the option to convert the coverage to permanent life when the child reaches a certain age.

Which type of life insurance policy is right for you?

When choosing a life insurance plan, it’s important to look at your full financial picture, budget, and how much coverage you need. Combining these three elements can guide you to the right life insurance policy.

For example, if you’re in your 30s, newly married, and planning to welcome your first child, you may need an affordable term life insurance option to cover the next 30 years until your child is grown and out of the house. On the other hand, if you’re in your 60s with a small amount of debt, a final expenses plan to cover funeral expenses could be a better fit.

No matter your situation, speaking with a licensed insurance agent is a great first step to determining the right life insurance policy.

Need to buy life insurance coverage?

Fidelity Life is one of the best life insurance companies, offering a range of affordable products to meet your needs. Backed by ratings from independent rating agencies like A.M. Best for financial stability, you can trust Fidelity Life to provide reliable protection for you and your loved ones.