Life insurance is a key safety net that gives you and your family financial security. It’s not the most thrilling topic, but it’s vital. Having a life insurance policy means your family is protected, no matter what.

Life insurance helps secure your family’s financial future and pays off debts. It offers many benefits that greatly impact your loved ones’ well-being. In this article, we’ll look at six key reasons to get a life insurance policy.

Key Takeaways

- Life insurance provides financial protection for your loved ones in the event of your passing.

- It can help cover outstanding debts, ensuring your family is not burdened with financial obligations.

- Life insurance policies offer tax benefits and financial advantages that can be leveraged for investment and retirement planning.

- Coverage options are available for different life stages, from young adults to retirees.

- Reviewing and updating your life insurance policy is crucial to ensure it continues to meet your changing needs.

Understanding Life Insurance: A Complete Overview

Life insurance is a key financial tool that offers protection and security. It helps individuals and their families. Knowing the basics of life insurance is important. We’ll cover the main points to help you choose wisely.

Term vs. Whole Life Insurance Explained

There are two main types of life insurance: term and whole. Term life covers you for a set time. Whole life covers you for life and builds cash value. Knowing the differences helps you pick the right policy for you.

How Life Insurance Policies Work

Life insurance works on a simple idea. You pay premiums, and the insurer pays a death benefit to your beneficiary when you pass. This benefit can pay off debts, cover future costs, or support your loved ones financially.

Basic Components of a Life Insurance Policy

- Death Benefit: The amount paid to the beneficiary upon the policyholder’s death

- Premium: The regular payment made to maintain the policy

- Term: The duration of coverage for a term life insurance policy

- Cash Value: The savings component of a whole life insurance policy

- Beneficiary: The individual(s) designated to receive the death benefit

Understanding these key parts helps you feel confident in your life insurance choices. It ensures your policy components and insurance basics meet your needs and financial goals.

“Life insurance is not just about protecting your family’s financial future; it’s about providing peace of mind in the face of life’s uncertainties.”

Financial Protection for Your Loved Ones

Life insurance is more than just a financial product. It’s a way to protect your loved ones’ future. It offers beneficiary protection, ensuring your family’s financial needs are met even when you’re not there. This coverage can replace your income, pay off debts, and cover important expenses like education or mortgage payments.

One key benefit of life insurance is its ability to replace your income. If you pass away unexpectedly, the death benefit can help your loved ones keep up with their lifestyle. This income replacement is especially important for families that depend on one income or whose financial stability relies on your earnings.

Life insurance also helps with settling debts or funeral expenses your loved ones might face. This can ease their financial worries during a tough time. It lets them focus on grieving and healing, without the stress of financial burdens.

“Life insurance is not just about protecting your family’s financial future – it’s about giving them the peace of mind and security they deserve.”

By ensuring your loved ones are financially secure, life insurance acts as a safety net. It gives you and your family the confidence to face the future, no matter what it brings.

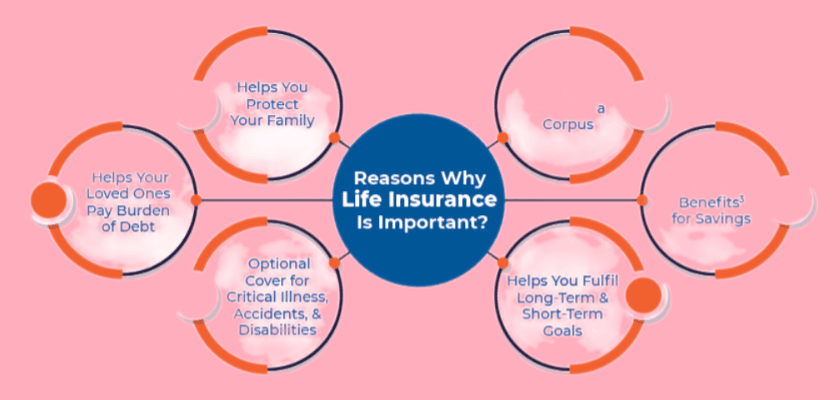

6 Reasons Why You Should Consider Buying Life Insurance

Life insurance offers great financial security for you and your family. It provides immediate protection and long-term benefits. Here are six key reasons to think about getting life insurance.

Securing Your Family’s Financial Future

Life insurance’s main goal is to keep your family financially stable if you pass away. It gives a tax-free death benefit. This helps pay for things like your mortgage, debts, and your kids’ education, keeping their security safe.

Coverage for Outstanding Debts

Life insurance also acts as a debt protection tool. It can pay off loans like your mortgage, car loan, or credit card balances. This relieves your family’s financial stress, letting them heal and move on without worrying about your debts.

Tax Benefits and Advantages

Life insurance offers tax-free benefits. The death benefit your loved ones get is usually not taxed by the federal government. This makes it a key part of estate planning, ensuring your family gets the financial support they need.

Also, some policies like whole life or universal life grow tax-deferred. This means you can use the cash value for things like retirement or emergencies.

“Life insurance is not just about protecting your family’s future; it’s about securing your own financial well-being and legacy.”

Understanding these six reasons can help you decide if life insurance is right for you. It ensures financial security for you and your loved ones.

Life Insurance as an Investment Tool

Life insurance is more than just a way to protect your loved ones. It can also be a smart investment. Policies like whole life and universal life insurance grow in value over time. This growth can help with your retirement plans.

The cash value part of these policies grows as you pay premiums. You can use this money through policy loans. This is great for adding to your retirement income or for unexpected expenses without harming your investments.

| Feature | Explanation |

|---|---|

| Cash Value Growth | The cash value of a whole life or universal life insurance policy grows on a tax-deferred basis, allowing for potential long-term accumulation of wealth. |

| Policy Loans | Policyholders can access the cash value of their life insurance policies through low-interest policy loans, providing a flexible source of funds. |

| Retirement Planning | Life insurance can be integrated into a comprehensive retirement planning strategy, leveraging the cash value for supplemental income or as a means of addressing financial obligations. |

Understanding life insurance’s investment potential can help you make the most of it. It’s a good way to boost your retirement planning, grow your cash value, and get funds through policy loans when you need them.

“Life insurance can be a powerful tool for building wealth and securing your financial future, especially when it comes to retirement planning.”

Coverage Options for Different Life Stages

Life insurance isn’t a one-size-fits-all deal. As people grow older, their insurance needs change. This is true for young adults, new families, mid-life career folks, and those nearing retirement.

Young Adults and New Families

Young adults and new families need a solid financial base. Life stage insurance helps with this. Term life insurance is a good choice because it’s affordable. It covers you for a set time, like 10 to 30 years.

This kind of insurance protects your family coverage. It ensures your loved ones are taken care of if you pass away too soon.

Mid-life Career Professionals

When you hit mid-career, your insurance needs might change. You might look at whole life insurance or universal life insurance. These options offer lifelong coverage and can grow in value.

This growth can help with retirement security or other big financial goals.

Retirement Planning with Life Insurance

As you get closer to retirement, life insurance becomes key to your financial plan. Permanent life insurance, like whole or universal life, grows tax-free. It also lets you use the policy’s cash value in retirement.

This can boost your retirement income and leave a lasting legacy for your family.

| Life Stage | Recommended Coverage | Key Benefits |

|---|---|---|

| Young Adults and New Families | Term Life Insurance | Affordable coverage, protects family in case of untimely death |

| Mid-life Career Professionals | Whole Life or Universal Life Insurance | Lifelong coverage, potential for cash value accumulation, retirement planning |

| Retirement Planning | Permanent Life Insurance | Tax-advantaged growth, access to cash value, legacy planning |

“Life insurance is not a one-time decision, but a lifelong process that evolves with your changing needs and priorities.”

Common Misconceptions About Life Insurance

Life insurance can be complex, leading to many misconceptions. We’ll clear up some common insurance myths and policy misconceptions. This will help you understand the coverage truths needed for informed life insurance decisions.

Many think life insurance is only for the elderly or those with families. But, it’s crucial for people of all ages. Another myth is that life insurance is too pricey. However, there are affordable options for every budget.

- Myth: Life insurance is only necessary for those with families or the elderly.

- Myth: Life insurance is too expensive to be worth it.

- Myth: Employer-provided life insurance is sufficient, negating the need for individual coverage.

- Myth: Life insurance policies are too complicated to understand.

Some believe employer-provided life insurance is enough. But, group coverage has its limits. Others are put off by the thought of complex policies. Yet, life insurance can be simple and customized to fit your needs.

| Misconception | Reality |

|---|---|

| Life insurance is only for the elderly or those with families. | Life insurance can benefit individuals of all ages and life stages. |

| Life insurance is too expensive. | Affordable options are available to fit a range of budgets. |

| Employer-provided life insurance is sufficient. | Group coverage has limitations and may not meet individual needs. |

| Life insurance policies are too complicated. | Life insurance policies can be straightforward and tailored to individual needs. |

By understanding and debunking these insurance myths and policy misconceptions, you can make better choices. This ensures you and your loved ones are well-protected.

How to Choose the Right Life Insurance Policy

Choosing the right life insurance policy can seem hard, but it’s key to protect your family’s money. When picking a policy, think about policy selection, coverage calculation, and provider comparison. There are important things to keep in mind.

Evaluating Insurance Providers

Start by researching insurance companies. Look for ones that are financially strong, have good customer reviews, and are reliable. Compare their prices, what they cover, and how happy customers are. This will help you find the best policy for you.

Understanding Policy Terms

Read the fine print of any policy you’re interested in. Make sure you know what’s covered, what’s not, and any special rules. Check the policy’s length, how much you’ll pay, and how to make a claim.

Calculating Coverage Needs

- Figure out how much coverage you need based on your family’s bills, living costs, and future plans.

- Think about your age, health, and income to make sure you have enough protection for your family.

- Use online tools or talk to a financial advisor to figure out the right coverage for you.

By carefully looking at insurance providers, understanding policy details, and figuring out your coverage needs, you can choose the best life insurance for your family.

When to Review and Update Your Coverage

Having the right life insurance is key to financial planning. But, many forget to review and update their coverage as their lives change. Being proactive helps protect your loved ones’ financial well-being now and later.

There are important times to think about updating your life insurance policy:

- Major life changes, like getting married, having a child, or buying a new home

- Big changes in income, whether it goes up or down

- Reaching important milestones, like a new job, a promotion, or retirement

- Experiencing health changes that might affect your coverage cost

- Deciding to relocate to a new state or country

- Reviewing your overall financial goals and priorities

By regularly reviewing your life insurance policy, you can make sure your coverage updates match your changing needs. This way, you can give your loved ones the financial security they need, both now and in the future.

Remember, reviewing your life insurance policy is an ongoing task, not just a one-time thing. Stay alert and update your coverage as needed to protect your family’s financial future, no matter what life brings.

Conclusion

Life insurance is key to good financial planning and keeping your loved ones safe. It’s important for everyone, no matter your age or life stage. Having the right coverage gives you financial protection and peace of mind.

Life insurance helps protect your family’s future and can even be an investment. Knowing about different policies and coverage options is crucial. This way, your life insurance fits your financial planning and family protection goals.

Life insurance is more than just a safety net. It shows your love and commitment to your family’s future. As you grow and take on more financial responsibilities, life insurance can greatly impact your life and your family’s.

FAQ

What is the purpose of life insurance?

Life insurance gives financial protection to your loved ones if you pass away too soon. It helps them keep their lifestyle without worrying about debts or losing income.

What are the different types of life insurance?

There are two main types: term life and whole life insurance. Term life covers you for a set time. Whole life insurance lasts forever and also grows in value.

How does life insurance work?

You pay premiums to an insurance company. In return, they promise to pay a death benefit to your beneficiaries if you die during the policy term.

What are the key components of a life insurance policy?

A policy has several key parts. These include the death benefit, premium, policy term, coverage amount, and the people you choose to receive the payout.

How does life insurance provide financial protection for my loved ones?

Life insurance can replace your income and pay off debts. It also covers funeral costs and helps with future needs like education or mortgage payments. This ensures your family’s financial safety even without you.

What are the main reasons to consider buying life insurance?

Buying life insurance secures your family’s future and protects against debts. It offers tax benefits, replaces income, covers final expenses, and can be an investment tool.

How can life insurance be used as an investment tool?

Some policies, like whole life or universal life, have a cash value that grows. You can use this cash for loans or withdrawals, making life insurance a way to build wealth for retirement.

How do my life insurance needs change over time?

Your needs change as you age. Young adults need more coverage for families. Mid-career people adjust policies for more income and assets. Retirees may use it in their financial planning.

What are some common misconceptions about life insurance?

Many think life insurance is only for breadwinners or is too expensive. It’s also believed to be for older people or hard to get. But, it can fit various budgets and life stages.

How do I choose the right life insurance policy?

Choose by comparing providers, understanding policy terms, and calculating your needs. Consider your income, debts, and dependents.

When should I review and update my life insurance coverage?

Review and update after big life changes like marriage, a child, a job, or retirement. This keeps your policy current with your life and finances.

Thank you for your articles. They are very helpful to me. May I ask you a question?

You helped me a lot by posting this article and I love what I’m learning.

Please tell me more about your excellent articles